Egon von Greyerz is one of my favourite prophets of gloom and doom, not least because I believe him to be right. We're going to see an implosion of the current monetary system, and only those with hard assets and a minimum of debt are going to get through the mess relatively unscathed.

There's too much debt and too much risk in the system for this to end any other way than badly. Even a tiny market move in an unexpected direction can result in giant losses. That's what we get for having $2.3 quadrillion in debt and derivatives, all balanced on top of a few trillion in equity.

This is not a new insight. I wrote about this a year ago, and as predicted back then, an awful lot of dollars have been printed in order to keep the system from falling apart. But this hasn't fixed anything. An even larger amount of dollars will have to be injected into financial markets next time we have a hick-up, and this will go on unabated until the dollar is completely destroyed.

|

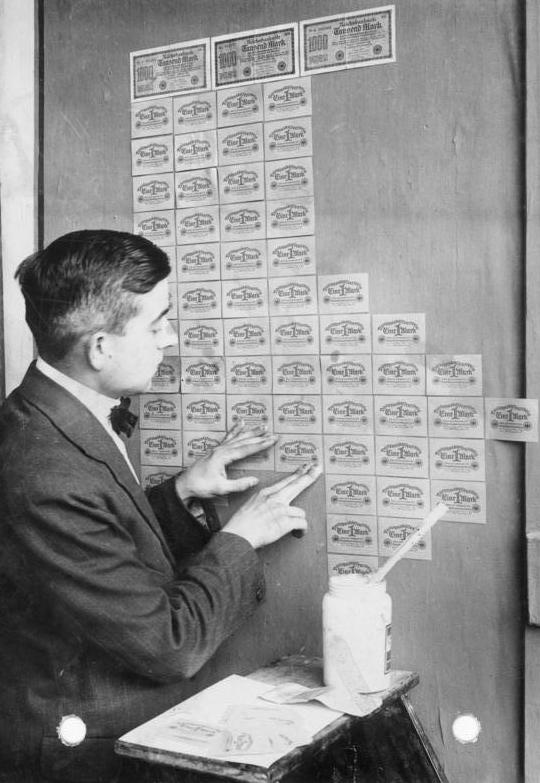

| Worthless paper money |

No comments:

Post a Comment