In a free market, the price of a product or service will always find an equilibrium where offer and bid meet and the market clears. Imbalances are always met with price changes that serve to re-balance offer and bid. However, we don't have a free market, so things don't always work this way. Certainly not when it comes to money, which is centrally planned through central banking.

What is currently happening in money markets illustrates quite clearly how a centrally organized economy fails to balance. Determined to keep interest rates artificially low, the FED is offering to buy government bonds at prices that are higher than what the free market is willing to pay. Consequently, banks and other institutions that hold such bonds flock to the FED in order to get the above market price. The free market has dried up, and there's suddenly a shortage of bonds.

The right response to this would be to let the price of these bonds fall so that the free market can return to equilibrium. But this is not the remedy that the central planners have chosen. They have instead decided that the federal government should issue more debt so as to replenish the supply.

This sets up a free and guaranteed way for banks to make money, because the federal government is required to issue their bonds to primary dealers that get the bonds on their books at a lower price than what the central bank is willing to pay. All that is needed for these banks to make money is for them to buy the debt from the government and then immediately sell it into the hands of the central bank. The difference in price between what the government is selling their debt for, relative to the price offered by the central bank, is pure profit conjured out of nothing.

Once the profit is locked in, banks can go out and buy stuff, preferably stuff that the central bank is willing to buy. The banks are in this manner in the privileged position of being the only entities that can sell stuff directly to the central bank. They can offer almost any price for certain assets, knowing that the central bank will buy the assets for a higher price.

What happens next is that there is a flood of cash entering the market. This is cash that originated from nothing at the central bank, and which has made the primary dealers rich on its way towards the free market. This pushes up prices of all things. The average person will see prices rise. Everything gets more expensive. Bankers become rich while the average person becomes poor, all thanks to the unholy trinity of government, primary dealers and central banks.

Tuesday, March 31, 2020

Sunday, March 29, 2020

For Future Generations

The Norwegian Sovereign Wealth Fund is the biggest sovereign wealth fund in the world. Its objective is to safeguard for future generations the economic advantage that Norway is currently in due to its income form the petroleum sector of the economy.

Nicolai Tangen, a successful hedge fund manager, is the new head of this organization, which may seem reasonable at first glance. However, Nicolai Tangen must necessarily have engaged in some pretty risky operations in order to have amassed the sort of fortune for himself that he has been able to gain over the years. It's doubtful that such a strategy would be appropriate for a wealth fund, so his experience may not be as valuable as it seems.

There is also the issue of conflict of interest. How will Mr. Tangen act in cases where the interests of his private wealth fund is in conflict with the interest of the sovereign wealth fond. Will he be able to resist the temptation to drain the sovereign wealth fund to the advantage of his private hedge fund. How will this man act in a time of crisis?

Yet, there is an even more troubling issue at hand. Mr. Tangen does not believe in the very concept of inheritance. He is of the stated opinion that all wealth should be either consumed or given away after a generation is up. There should be no transfer of wealth from one generation to the next. In other words, he does not believe in the wealth fund's aim to safeguard future generations. If he is consistent in his thinking, the wealth fund must be completely drained or given away within the coming decade so that no-one growing up in Norway today are in any way advantaged relative to people growing up in other countries.

It is hard to believe that Mr. Tangen actually believes in his own words, and we must hope that he is in fact a twit and an extremely bad public speaker. But if this is not the case, and his views on inheritance is a general reflection of thoughts circulating among the political elite, then future generations may turn out to be completely deprived of any economic advantage that they might otherwise have had.

The political elite, which happen to be notorious for having no children, are not themselves in any danger from Mr. Tangen. Quite the opposite is the case, because Mr. Tangen appears to feel it appropriate to consume the entire wealth fund within the coming decade or so, especially by people who have no children to whom the windfall could be re-directed. Mr. Tangen's rather extreme view on inheritance may therefore be more mainstream among the political elite than it is in the general public.

This leads us to the possibility that Mr. Tangen's proposed 100% inheritance tax will become law, so that the political elite can consume for themselves, not only the sovereign wealth fund, but also all accumulated wealth in the private sector. According to Mr. Tangen's vision for the future of Norway, all farms, all land, and all private businesses should become nationalized within a generation, and the wealth should be sold off to foreign interests so that the political elite can consume it or give it away to foreign nations.

This is so crazy that it is unlikely that anyone will actually enact such a law, but let us for a moment consider the possibility. What would be the best way to navigate around such a law?

Assuming that sales tax remain below 100%, all people interested in giving an inheritance to their children will start off by selling what they have to their children at as low an evaluation as possible. That rate will be very low, because ownership of private property has become a lot less attractive with the new inheritance tax, so the sale to the younger generation will be relatively painless. However, such a sale may result in the older generation having far more cash than they wish to consume. In such a case, the older generation can buy gold and silver coins, presumably still with little or no sales tax. These coins can then be handed over to the younger generation as a private, undocumented, gift.

This will bring a lot of gold and silver coins into the parallel economy, which operates outside of state control. There will be two economies: One official in which nothing has much value due to the inheritance tax. The parallel economy will have prices set in coin, with no transaction fees, and no taxes.

Even if the political elite enacts the draconian law proposed by Mr. Tangen, they will fail to nationalize everything. The economy will instead go under ground, and resistance and disobedience to the state will become the norm.

Nicolai Tangen, a successful hedge fund manager, is the new head of this organization, which may seem reasonable at first glance. However, Nicolai Tangen must necessarily have engaged in some pretty risky operations in order to have amassed the sort of fortune for himself that he has been able to gain over the years. It's doubtful that such a strategy would be appropriate for a wealth fund, so his experience may not be as valuable as it seems.

There is also the issue of conflict of interest. How will Mr. Tangen act in cases where the interests of his private wealth fund is in conflict with the interest of the sovereign wealth fond. Will he be able to resist the temptation to drain the sovereign wealth fund to the advantage of his private hedge fund. How will this man act in a time of crisis?

Yet, there is an even more troubling issue at hand. Mr. Tangen does not believe in the very concept of inheritance. He is of the stated opinion that all wealth should be either consumed or given away after a generation is up. There should be no transfer of wealth from one generation to the next. In other words, he does not believe in the wealth fund's aim to safeguard future generations. If he is consistent in his thinking, the wealth fund must be completely drained or given away within the coming decade so that no-one growing up in Norway today are in any way advantaged relative to people growing up in other countries.

It is hard to believe that Mr. Tangen actually believes in his own words, and we must hope that he is in fact a twit and an extremely bad public speaker. But if this is not the case, and his views on inheritance is a general reflection of thoughts circulating among the political elite, then future generations may turn out to be completely deprived of any economic advantage that they might otherwise have had.

The political elite, which happen to be notorious for having no children, are not themselves in any danger from Mr. Tangen. Quite the opposite is the case, because Mr. Tangen appears to feel it appropriate to consume the entire wealth fund within the coming decade or so, especially by people who have no children to whom the windfall could be re-directed. Mr. Tangen's rather extreme view on inheritance may therefore be more mainstream among the political elite than it is in the general public.

This leads us to the possibility that Mr. Tangen's proposed 100% inheritance tax will become law, so that the political elite can consume for themselves, not only the sovereign wealth fund, but also all accumulated wealth in the private sector. According to Mr. Tangen's vision for the future of Norway, all farms, all land, and all private businesses should become nationalized within a generation, and the wealth should be sold off to foreign interests so that the political elite can consume it or give it away to foreign nations.

This is so crazy that it is unlikely that anyone will actually enact such a law, but let us for a moment consider the possibility. What would be the best way to navigate around such a law?

Assuming that sales tax remain below 100%, all people interested in giving an inheritance to their children will start off by selling what they have to their children at as low an evaluation as possible. That rate will be very low, because ownership of private property has become a lot less attractive with the new inheritance tax, so the sale to the younger generation will be relatively painless. However, such a sale may result in the older generation having far more cash than they wish to consume. In such a case, the older generation can buy gold and silver coins, presumably still with little or no sales tax. These coins can then be handed over to the younger generation as a private, undocumented, gift.

This will bring a lot of gold and silver coins into the parallel economy, which operates outside of state control. There will be two economies: One official in which nothing has much value due to the inheritance tax. The parallel economy will have prices set in coin, with no transaction fees, and no taxes.

Even if the political elite enacts the draconian law proposed by Mr. Tangen, they will fail to nationalize everything. The economy will instead go under ground, and resistance and disobedience to the state will become the norm.

By Unknown author - http://www.artres.com/Doc/ART/Media/TR3/F/M/8/Q/ART1662.jpg, Public Domain, Link

Saturday, March 28, 2020

For the Common Good

Something strange is going on in Norway. The political elite has decided to lock down the country for weeks on end. This is supposedly for the common good of the people, but the economic destruction that this decision entails are such that it is hard to see exactly who will benefit from this in the long run. We are talking mass layoffs, bankruptcies, misery and suicides that will most likely dwarf the immediate health benefits from the lock-down. The decision is therefore not for the common good. It is to the benefit of the weak and elderly, at the long term cost of the young and healthy.

So, why would the political elite make such a decision? Who exactly are they protecting at this tremendous cost? Could it be that the decision is based on private and immediate priorities of the elite itself? Specifically, is the prime minister protecting herself at the expense of the entire nation? She's after all obese. She might not survive the virus if she catches it. To her, no cost is too big to make sure she doesn't get it, and she bears no economic cost to herself by letting everybody down. Her future is financially secure. Her only concern as far as she is concerned is her own survival.

So, why would the political elite make such a decision? Who exactly are they protecting at this tremendous cost? Could it be that the decision is based on private and immediate priorities of the elite itself? Specifically, is the prime minister protecting herself at the expense of the entire nation? She's after all obese. She might not survive the virus if she catches it. To her, no cost is too big to make sure she doesn't get it, and she bears no economic cost to herself by letting everybody down. Her future is financially secure. Her only concern as far as she is concerned is her own survival.

By Pernille Ingebrigtsen / Arctic Frontiers - http://www.mynewsdesk.com/no/akvaplan-niva/images/erna-solberg-448725, CC BY 3.0, Link

Friday, March 27, 2020

Honest Italians

The flu isn't hitting every country the same way, and much has been thought and said about this fact. Why, for instance, are the numbers out of Italy so much more ugly than numbers coming out of Scandinavia? Why is the mortality rate about 8% in Italy and more like 2% in Norway?

While the transmission speed of the flu can be attributed to differences in culture, the mortality rate is harder to explain. Transmission is a factor of social interaction, which is higher in Italy than in Norway. But why are Norwegians who get the disease 4 times more likely to survive than in Italy?

To answer this question, we have to keep in mind that the biggest difference between countries is not their health care system or general health of their populations, but the way things are recorded and published. Norway and Italy are not following the same rule-book. The difference in their statistics are therefore almost certainly due to this. While an old person dying with the flu in Italy is recorded as dying with the flu, an old person suffering from the very same disease in Norway may be recorded as dead from multiple complications related to old age and poor health.

Note that the Italians do not tell us if the patient died of the flu. What is noted is that the flu was one of the diseases that the patient was suffering from when he or she died. That's quite different from saying that the flu was the cause of the patient's death. The Italians list all the diseases, while the Norwegians note down the most prevalent one. Of the people in Italy who died with the flu, less than 2% were suffering from the flu alone. All other deaths were due to some combination of diseases.

While the transmission speed of the flu can be attributed to differences in culture, the mortality rate is harder to explain. Transmission is a factor of social interaction, which is higher in Italy than in Norway. But why are Norwegians who get the disease 4 times more likely to survive than in Italy?

To answer this question, we have to keep in mind that the biggest difference between countries is not their health care system or general health of their populations, but the way things are recorded and published. Norway and Italy are not following the same rule-book. The difference in their statistics are therefore almost certainly due to this. While an old person dying with the flu in Italy is recorded as dying with the flu, an old person suffering from the very same disease in Norway may be recorded as dead from multiple complications related to old age and poor health.

Note that the Italians do not tell us if the patient died of the flu. What is noted is that the flu was one of the diseases that the patient was suffering from when he or she died. That's quite different from saying that the flu was the cause of the patient's death. The Italians list all the diseases, while the Norwegians note down the most prevalent one. Of the people in Italy who died with the flu, less than 2% were suffering from the flu alone. All other deaths were due to some combination of diseases.

Thursday, March 26, 2020

False Dawn

First, there was 1 case. A week later, there were 10. Then 100 and 1,000 the following two weeks. If it wasn't for the draconian shut down of Portugal, we would be at 10,000 by now. However, we are no longer seeing a tenfold in cases every week. That now takes two weeks. The peek of the outbreak has been pushed into the future. But it is still the case that we will not see any herd immunity before about 60% of the population has had the flu. If the government declares victory too early, there will be a spike in cases.

With 10,000,000 people, Portugal needs 6,000,000 (60%) cured cases before we can safely return to our old routines. This will be about three weeks after the peek of about 2,000,000 (20%) sick people, which in turn is one or two weeks after we see 200,000 (2%) cases. The sensible thing to do is therefore to stay low for at least three weeks after we reach 200,000 cases, because it is in the period after this milestone is reached that the vast majority of people will be infected. The trick is therefore to estimate when we are at 200,000 cases.

With a lot of people getting this flu without much in the way of symptoms, and a lot of people simply weathering it out at home, we may have to multiply the official figures by as much as ten to get at the true figures. In that case, we'll have to keep our eyes open for the announcement of 20,000 (0.2%) official cases. This number will be announced at, or shortly before, the date when the actual number of cases reach 200,000 (2%).

If the government declares victory before we have an official count of at least 200,000 (2%) cases, we're being misled. The number of cases will explode shortly after such a premature announcement.

The responsible thing to do is therefore to stock up with essentials and keep a minimum social interaction lifestyle from the date that government either admits to 20,000 (0.2%) official cases, or declare victory, whichever comes first, until tree weeks later when the worst of the outbreak should be over, and herd immunity has been established.

With 10,000,000 people, Portugal needs 6,000,000 (60%) cured cases before we can safely return to our old routines. This will be about three weeks after the peek of about 2,000,000 (20%) sick people, which in turn is one or two weeks after we see 200,000 (2%) cases. The sensible thing to do is therefore to stay low for at least three weeks after we reach 200,000 cases, because it is in the period after this milestone is reached that the vast majority of people will be infected. The trick is therefore to estimate when we are at 200,000 cases.

With a lot of people getting this flu without much in the way of symptoms, and a lot of people simply weathering it out at home, we may have to multiply the official figures by as much as ten to get at the true figures. In that case, we'll have to keep our eyes open for the announcement of 20,000 (0.2%) official cases. This number will be announced at, or shortly before, the date when the actual number of cases reach 200,000 (2%).

If the government declares victory before we have an official count of at least 200,000 (2%) cases, we're being misled. The number of cases will explode shortly after such a premature announcement.

The responsible thing to do is therefore to stock up with essentials and keep a minimum social interaction lifestyle from the date that government either admits to 20,000 (0.2%) official cases, or declare victory, whichever comes first, until tree weeks later when the worst of the outbreak should be over, and herd immunity has been established.

Thursday, March 19, 2020

Watching the NOK

The gold price measured in euros or dollars has been hammered lately. People are desperate for these reserve currencies in their rush to pay down debt and finance emergency measures, so they are willing to sell anything, including gold, in order to get hold on the required cash.

However, this situation is unlikely to persist for long. Both the EU and US are announcing rescue packages of various kinds. Central banks are about to flood the world with liquidity. What will happen next is likely to be what we're currently seeing in the Norwegian Krone (NOK).

The Norwegian government has announced all sorts of rescue packages. With a giant sovereign wealth fund to draw on, it figured itself well positioned for this. However, the effect on the NOK has been catastrophic. After a long and slow slide, the NOK fell off a cliff this week. A 20% fall in a matter of days has seen the gold price reach an all time high when measured in NOK.

As a gold owner, watching the NOK collapse like this has given me a great boost in confidence. We may momentarily be a little down relative to euros and dollars, but relative to the NOK we're doing just fine. Relative to the stock markets, we're also up by quite a lot, and we will most certainly be up in euros and dollars in the near to medium term future.

However, this situation is unlikely to persist for long. Both the EU and US are announcing rescue packages of various kinds. Central banks are about to flood the world with liquidity. What will happen next is likely to be what we're currently seeing in the Norwegian Krone (NOK).

The Norwegian government has announced all sorts of rescue packages. With a giant sovereign wealth fund to draw on, it figured itself well positioned for this. However, the effect on the NOK has been catastrophic. After a long and slow slide, the NOK fell off a cliff this week. A 20% fall in a matter of days has seen the gold price reach an all time high when measured in NOK.

As a gold owner, watching the NOK collapse like this has given me a great boost in confidence. We may momentarily be a little down relative to euros and dollars, but relative to the NOK we're doing just fine. Relative to the stock markets, we're also up by quite a lot, and we will most certainly be up in euros and dollars in the near to medium term future.

Saturday, March 14, 2020

When the Price is Wrong

In a free market, the seller and buyer of a product or service must agree on a price, otherwise no exchange happens. This is not the case in a centrally controlled market in which prices are dictated by bureaucrats, and exchanges of goods and services happens at gunpoint.

In this respect, it's interesting to see what is currently happening in the sovereign debt market where there are both free market and central market players. With the FED having interfered heavily in the US debt market to keep prices of US debt from falling, there are now virtually no-one willing to buy US debt voluntarily. The price is simply too high.

But if the FED let's the price of debt fall to the point where free market actors are interested in buying it, interest rates will skyrocket. This is not an option, because it would cripple the US government, so the only option available to the US government is for the FED to become an evermore dominant buyer of its debt. People will no longer give up their hard earned money to buy this. Only money printed out of thin air will go into the debt market. As a consequence, there will soon be an avalanche of freshly printed dollars hitting the free market of goods and services.

In this respect, it's interesting to see what is currently happening in the sovereign debt market where there are both free market and central market players. With the FED having interfered heavily in the US debt market to keep prices of US debt from falling, there are now virtually no-one willing to buy US debt voluntarily. The price is simply too high.

But if the FED let's the price of debt fall to the point where free market actors are interested in buying it, interest rates will skyrocket. This is not an option, because it would cripple the US government, so the only option available to the US government is for the FED to become an evermore dominant buyer of its debt. People will no longer give up their hard earned money to buy this. Only money printed out of thin air will go into the debt market. As a consequence, there will soon be an avalanche of freshly printed dollars hitting the free market of goods and services.

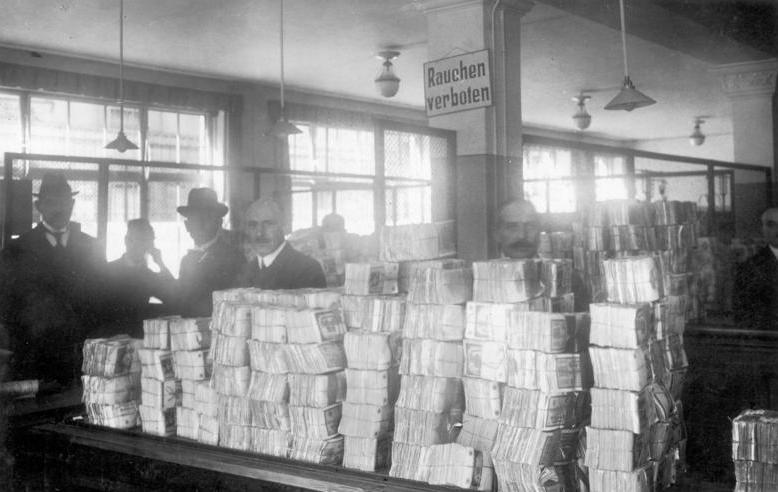

By Bundesarchiv, Bild 183-R1215-506 / CC-BY-SA 3.0, CC BY-SA 3.0 de, Link

Friday, March 13, 2020

Keeping William Home from School

We decided to keep our eight year old son home from school this week. The immediate reason for this was the arrival in Porto of the Wuhan coronavirus. With both myself and my wife spending our days at home anyway, we saw no reason to risk anything when it comes to our health. As far as we are concerned, William's school is little more than a convenient place to drop him off so that he can be with friends while my wife and I concentrate on other things. It's not like William misses out on a lot of important stuff by staying home, so we decided to err on the side of caution. Better safe than sorry as they say.

A secondary reason for keeping William home is the fact that some parents have pressing matters they must attend to. They have little choice but to drop their children off at school, even if they would prefer to keep them at home. By keeping William home, we're helping these parents by reducing the number of people in the classroom. It reduces the density of individuals, and therefore the chances of any one individual becoming infected. By keeping William at home, we're denying the virus one of its possible transmission routes.

However, we're not keeping ourselves completely isolated from society. We cannot avoid going to the local grocery store, and staying indoors every day is quite intolerable. We need to go out and catch some sun and fresh air, or else we're going to go a little nuts. So we go for the occasional stroll. We also sit down for a coffee on our way. As long as the coffee shop isn't too crowded, the risk of catching the virus while we're there should be minimal.

Still, I suspect we'll end up getting the virus at some point. If it is as contagious as it appears, just about everybody will get it at some point. But that's no reason to relax our self imposed isolation. There's no point in trying to get this thing early.

A secondary reason for keeping William home is the fact that some parents have pressing matters they must attend to. They have little choice but to drop their children off at school, even if they would prefer to keep them at home. By keeping William home, we're helping these parents by reducing the number of people in the classroom. It reduces the density of individuals, and therefore the chances of any one individual becoming infected. By keeping William at home, we're denying the virus one of its possible transmission routes.

However, we're not keeping ourselves completely isolated from society. We cannot avoid going to the local grocery store, and staying indoors every day is quite intolerable. We need to go out and catch some sun and fresh air, or else we're going to go a little nuts. So we go for the occasional stroll. We also sit down for a coffee on our way. As long as the coffee shop isn't too crowded, the risk of catching the virus while we're there should be minimal.

Still, I suspect we'll end up getting the virus at some point. If it is as contagious as it appears, just about everybody will get it at some point. But that's no reason to relax our self imposed isolation. There's no point in trying to get this thing early.

Tuesday, March 10, 2020

An Irrational Inability to Act

Malmö in Sweden must be one of the most politically correct places on Earth, which means that there are a whole range of things that people do not allow themselves to say or do. Foremost of this is any criticism of people who are not ethnically Swedish. People with a different skin color from the ethnic Swede are per definition good and well meaning.

This led to a rather comical situation during the women's rights march held in Malmö last Sunday. A gang of Muslims decided to join in. They marched rather menacingly next to the women, something the women in their political correctness had to ignore, as these men by definition are on their side in the fight for justice. Not even when one of the Muslims held up a sign stating plainly and clearly in correctly written Swedish that Sweden must dies, could any of the women bring themselves to the point of protest. Instead, they quietly accepted the idea that "Sweden must die" as somehow in line with the idea of women's rights in general.

The long term effect of this is of course that women's rights in Sweden will be associated with wonky radical ideas pertaining to genocide and civil war. This one Muslim anti-women's-right protester managed to cause long term damage to the women's rights movement in Sweden, simply by exploiting the fact that he could not be confronted or contradicted due to political correct doctrine.

Meanwhile at the Greek-Turkish border, Turkish border guards tore down the barbed wire fence holding tens of thousand Muslims back from invading Europe. Armed thugs started to cross the border into Greece. However, a bit of quick thinking on the part of the Greeks have saved the day for now. Tractors, hauling tanks full of pig's piss and manure headed for the border where they immediately started to spray their fouls smelling, but largely harmless cargo out along the no-man's land separating the two countries.

A whole army of would be invaders have thus been kept at bay, not by any physical means, but by the deep seated superstition of the average Muslim. The same type of irrational thinking that prevented the Swedish women to call out their Muslim co-protesters, is preventing hordes of Muslim invaders from crossing a border that is largely unprotected. In the minds of brainwashed people, certain things cannot be done, not because it is physically impossible, but because the act cannot be thought, let alone acted out.

This led to a rather comical situation during the women's rights march held in Malmö last Sunday. A gang of Muslims decided to join in. They marched rather menacingly next to the women, something the women in their political correctness had to ignore, as these men by definition are on their side in the fight for justice. Not even when one of the Muslims held up a sign stating plainly and clearly in correctly written Swedish that Sweden must dies, could any of the women bring themselves to the point of protest. Instead, they quietly accepted the idea that "Sweden must die" as somehow in line with the idea of women's rights in general.

The long term effect of this is of course that women's rights in Sweden will be associated with wonky radical ideas pertaining to genocide and civil war. This one Muslim anti-women's-right protester managed to cause long term damage to the women's rights movement in Sweden, simply by exploiting the fact that he could not be confronted or contradicted due to political correct doctrine.

Meanwhile at the Greek-Turkish border, Turkish border guards tore down the barbed wire fence holding tens of thousand Muslims back from invading Europe. Armed thugs started to cross the border into Greece. However, a bit of quick thinking on the part of the Greeks have saved the day for now. Tractors, hauling tanks full of pig's piss and manure headed for the border where they immediately started to spray their fouls smelling, but largely harmless cargo out along the no-man's land separating the two countries.

A whole army of would be invaders have thus been kept at bay, not by any physical means, but by the deep seated superstition of the average Muslim. The same type of irrational thinking that prevented the Swedish women to call out their Muslim co-protesters, is preventing hordes of Muslim invaders from crossing a border that is largely unprotected. In the minds of brainwashed people, certain things cannot be done, not because it is physically impossible, but because the act cannot be thought, let alone acted out.

Imminent Sovereign Debt Implosion

Sovereign debt has been bid these past couple of weeks. The idea is that government issued bonds are safe. However, this misses the point that sovereign debt derives its ultimate value from the government's ability to levy taxes on its subjects. If this ability is reduced, the debt cannot be sustained. It will be defaulted on, either through monetary inflation, or through outright default.

Countries, such as Italy, with high levels of debt combined with a serious disruptions to their industries, are prime examples in this respect. There's no way Italy will be able to honor its debt through this crisis. It will either default right out, or it will ask the ECB to buy its debt with freshly printed Euros. Either way, there will be losses carried by bond holders. As a consequence of this, Italy's sovereign debt is already falling in value. A crisis in Italy's sovereign debt looks imminent.

But things will not be contained to Italy. Most western governments are currently heavily indebted. None of them will make it through a major recession without a hit to their sovereign debt, and with one country after another getting into trouble, the whole edifice of over-leveraged government structures is likely to crumble. Interest rates will explode higher, especially at the long end where central banks have little leverage. As a consequence, gold will head higher.

Those currently chasing sovereign debt will realize their mistake. The paper promises they are holding are going to go down in value. There will be a rush for the exit, and a bid for gold as the only true safe haven asset. This will in turn spark sharply higher interest rates on long dated papers. If central banks try to stop this by buying the long dated papers in order to suppress the spike in interest rates, their freshly printed currencies will only stoke the bid for gold. While money printing may keep interest rates from going exponential, it cannot at the same time keep gold from going higher. There is no way to avoid the coming reevaluation of sovereign debt relative to gold.

Countries, such as Italy, with high levels of debt combined with a serious disruptions to their industries, are prime examples in this respect. There's no way Italy will be able to honor its debt through this crisis. It will either default right out, or it will ask the ECB to buy its debt with freshly printed Euros. Either way, there will be losses carried by bond holders. As a consequence of this, Italy's sovereign debt is already falling in value. A crisis in Italy's sovereign debt looks imminent.

But things will not be contained to Italy. Most western governments are currently heavily indebted. None of them will make it through a major recession without a hit to their sovereign debt, and with one country after another getting into trouble, the whole edifice of over-leveraged government structures is likely to crumble. Interest rates will explode higher, especially at the long end where central banks have little leverage. As a consequence, gold will head higher.

Those currently chasing sovereign debt will realize their mistake. The paper promises they are holding are going to go down in value. There will be a rush for the exit, and a bid for gold as the only true safe haven asset. This will in turn spark sharply higher interest rates on long dated papers. If central banks try to stop this by buying the long dated papers in order to suppress the spike in interest rates, their freshly printed currencies will only stoke the bid for gold. While money printing may keep interest rates from going exponential, it cannot at the same time keep gold from going higher. There is no way to avoid the coming reevaluation of sovereign debt relative to gold.

By Unknown author - own archive, Public Domain, Link

Monday, March 9, 2020

Carry Trade Implosion

We live in interesting times. The Wuhan coronavirus has unleashed an unexpected downturns in industrial production, which in turn has pricked multiple asset bubbles. Clever schemes designed to make money from predictable moves are imploding everywhere.

This is particularly evident in the so called carry trade, where speculators borrow low interest currencies to finance asset purchases denominated in high interest currencies. People have borrowed Yen and Euro to buy the US stock market and speculative assets such as Bitcoin.

While this may seem like a great idea, it is inherently unstable and risky. It only works as long as the risky assets appreciate in value. When the bubbles created by carry trade eventually pop, there's tremendous pressure to unwind positions. Risk assets must be sold, and borrowed currencies must be bought. As a consequence, low interest currencies such as the Yen and the Euro explode higher while risk assets implode. When the dust finally settles, low interest currencies end up higher than where they started, and risk assets end up lower, the exact opposite of what the central planners had in mind when they implemented their low interest policies.

This is particularly evident in the so called carry trade, where speculators borrow low interest currencies to finance asset purchases denominated in high interest currencies. People have borrowed Yen and Euro to buy the US stock market and speculative assets such as Bitcoin.

While this may seem like a great idea, it is inherently unstable and risky. It only works as long as the risky assets appreciate in value. When the bubbles created by carry trade eventually pop, there's tremendous pressure to unwind positions. Risk assets must be sold, and borrowed currencies must be bought. As a consequence, low interest currencies such as the Yen and the Euro explode higher while risk assets implode. When the dust finally settles, low interest currencies end up higher than where they started, and risk assets end up lower, the exact opposite of what the central planners had in mind when they implemented their low interest policies.

By European Central Bank - www.ecb.int, Public Domain, Link

Saturday, March 7, 2020

Misconceptions About the Inquisition

The Holy Inquisition, instituted by the Catholic church in the 12th century, is associated with terrible methods of investigation and execution, involving all sorts of bizarre instruments of torture. While this is true, it is seldom mentioned that these very same methods were also used by secular courts at the time. Torture was part of all criminal investigations, and penalties were often brutal and inhumane.

The Inquisition was not unique in its bizarre rituals and investigations. What was unique and special about the Inquisition was not the way it was executed, but the fact that it was dedicated entirely to what we today call thought crimes. There were certain beliefs and thoughts that were illegal, and it was the task of the Inquisition to uncover such thoughts, and dish out appropriate punishments.

Furthermore, the methods of torture employed by the Inquisition were not invented by the Inquisition. They were invented by the secular court system and simply copied into the mechanics of investigation used by the Inquisition. As far as methodology, the Inquisition and the secular court systems were identical.

This means that if the Inquisition was to be reinstated today, it would take the form of a special branch of the judiciary system dedicated exclusively to thought crimes. It would not use different methods from other courts. Things would be done exactly as they are done in any other criminal investigation. However, this separate court would focus exclusively on politically incorrect ideas and attitudes. It would be a court with the power to bring in people based on public statements and on hearsay related to how they bring up their children, engage in commerce or generally transact in society.

The Inquisition was not unique in its bizarre rituals and investigations. What was unique and special about the Inquisition was not the way it was executed, but the fact that it was dedicated entirely to what we today call thought crimes. There were certain beliefs and thoughts that were illegal, and it was the task of the Inquisition to uncover such thoughts, and dish out appropriate punishments.

Furthermore, the methods of torture employed by the Inquisition were not invented by the Inquisition. They were invented by the secular court system and simply copied into the mechanics of investigation used by the Inquisition. As far as methodology, the Inquisition and the secular court systems were identical.

This means that if the Inquisition was to be reinstated today, it would take the form of a special branch of the judiciary system dedicated exclusively to thought crimes. It would not use different methods from other courts. Things would be done exactly as they are done in any other criminal investigation. However, this separate court would focus exclusively on politically incorrect ideas and attitudes. It would be a court with the power to bring in people based on public statements and on hearsay related to how they bring up their children, engage in commerce or generally transact in society.

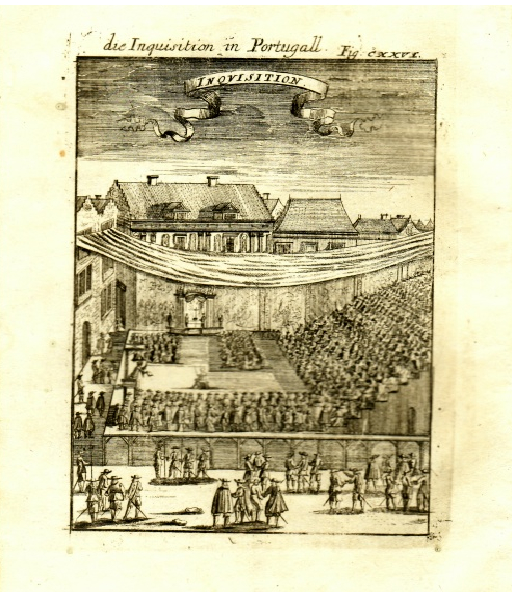

By Alain Manesson Mallet - Private Collections - Lisbon, Public Domain, Link

Monday, March 2, 2020

The 5th Empire - Bacurau

Bacurau, a weird western film set in Brazil, is interesting in many ways. At first, it comes across as a strange B-movie. But on closer inspection, the film makes multiple references to the 5th Empire.

First of all, the village where the bloody events of the film unfolds has no political structure. There is no mayor or priest dictating rules of good behavior. When the politician in charge of the province comes to visit, everyone shies away, uninterested in hearing what he has to say. It is clear that the man is full of himself, with no true interest in the village. His gifts to the town are of very limited value, and the price he charges is quite literally a "pound of flesh", or rather a prostitute that he takes with him as his reward for being a great "ruler".

The little that is of value in the truckload of goods the politician dumped in the village is sorted into categories. Food that is out of date is separated from that which is still current. Medicines that are of benefit if taken correctly are separated from that which has known harmful side-effects. But the doctor and school teacher that do the sorting do not distribute the goods. They simply categorize them. It is up to everyone in the village to make up their own minds as to what they want to take for themselves. The experts give advice. They do not run things. They do not govern anybody.

The school teacher is very proud of his family. It's full of people of all professions and inclinations. There are doctors and engineers and architects and shop keepers. The list goes on and on. But there are no thieves. There is not a single thief in his family, a clear reference to the 5th Empire in which the only crime is to take something that does not belong to ourselves, be it someones life, liberty or property.

However, the village has no trouble accepting a retired "gun for hire" among themselves. They are not scared of him. In fact, he commands a certain degree of admiration. The reason for this is that he never killed anyone who wasn't a thief. He did not kill at random. Only those who had done serious harm to others had anything to worry about.

Bacurau is a dirty, dusty village, with plenty of vice. There's prostitution and drug taking. But there is no theft. No-one is hurting others or damaging people's properties on purpose. What makes Bacurau an example village in the 5th Empire is not wealth and prosperity, but freedom and respect. No-one is treated worse than others. Not even the prostitutes.

On the other hand, the villains operate with all sorts of rules. They are well organized and of relatively prosperous backgrounds. But they are breaking the golden rule. They kill for fun, and their chosen targets are villagers in Bacurau, which they find vile and dirty. However, they soon start to mistrust each other. They suspect each others of being dangerously unstable. They recoil in horror when others reveal their twisted fantasies. These people are firmly outside of the 5th Empire. They exist in a state of chaos.

Illustrating this even more firmly, we are introduce to a very dangerous man whom the villagers have decided to leave alone as he hides out at the local dam, outside of the village. This man is wanted by the police for horrendous murders and mutilations, but since he never posed any danger to the locals, and the retired hit man knows him as only dangerous to those who are dangerous themselves, they do not report the man to the police. When the locals realize that they are under attack, they ask him to come and help them. Even the most dangerous of men are let into the 5th Empire as long as they abide by the golden rule.

What follows is a serious of incidents in which the villains become increasingly unhinged, and eventually massacred by the retired hit man, his outlaw friend, and a number of other villagers.

When the politician returns to the village, it becomes clear that he was the one that put the village in danger by suggesting it as a good hunting ground for the villains. For this, he too is punished. Politicians are not beyond the law of the 5th Empire.

First of all, the village where the bloody events of the film unfolds has no political structure. There is no mayor or priest dictating rules of good behavior. When the politician in charge of the province comes to visit, everyone shies away, uninterested in hearing what he has to say. It is clear that the man is full of himself, with no true interest in the village. His gifts to the town are of very limited value, and the price he charges is quite literally a "pound of flesh", or rather a prostitute that he takes with him as his reward for being a great "ruler".

The little that is of value in the truckload of goods the politician dumped in the village is sorted into categories. Food that is out of date is separated from that which is still current. Medicines that are of benefit if taken correctly are separated from that which has known harmful side-effects. But the doctor and school teacher that do the sorting do not distribute the goods. They simply categorize them. It is up to everyone in the village to make up their own minds as to what they want to take for themselves. The experts give advice. They do not run things. They do not govern anybody.

The school teacher is very proud of his family. It's full of people of all professions and inclinations. There are doctors and engineers and architects and shop keepers. The list goes on and on. But there are no thieves. There is not a single thief in his family, a clear reference to the 5th Empire in which the only crime is to take something that does not belong to ourselves, be it someones life, liberty or property.

However, the village has no trouble accepting a retired "gun for hire" among themselves. They are not scared of him. In fact, he commands a certain degree of admiration. The reason for this is that he never killed anyone who wasn't a thief. He did not kill at random. Only those who had done serious harm to others had anything to worry about.

Bacurau is a dirty, dusty village, with plenty of vice. There's prostitution and drug taking. But there is no theft. No-one is hurting others or damaging people's properties on purpose. What makes Bacurau an example village in the 5th Empire is not wealth and prosperity, but freedom and respect. No-one is treated worse than others. Not even the prostitutes.

On the other hand, the villains operate with all sorts of rules. They are well organized and of relatively prosperous backgrounds. But they are breaking the golden rule. They kill for fun, and their chosen targets are villagers in Bacurau, which they find vile and dirty. However, they soon start to mistrust each other. They suspect each others of being dangerously unstable. They recoil in horror when others reveal their twisted fantasies. These people are firmly outside of the 5th Empire. They exist in a state of chaos.

Illustrating this even more firmly, we are introduce to a very dangerous man whom the villagers have decided to leave alone as he hides out at the local dam, outside of the village. This man is wanted by the police for horrendous murders and mutilations, but since he never posed any danger to the locals, and the retired hit man knows him as only dangerous to those who are dangerous themselves, they do not report the man to the police. When the locals realize that they are under attack, they ask him to come and help them. Even the most dangerous of men are let into the 5th Empire as long as they abide by the golden rule.

What follows is a serious of incidents in which the villains become increasingly unhinged, and eventually massacred by the retired hit man, his outlaw friend, and a number of other villagers.

When the politician returns to the village, it becomes clear that he was the one that put the village in danger by suggesting it as a good hunting ground for the villains. For this, he too is punished. Politicians are not beyond the law of the 5th Empire.

Stock Market All Time High

Measured in dollars, the all time high in the US stock market happened a little over a week ago. However, the dollar is not a good store of value. It cannot be used to compare historic prices very well.

When measured against gold, the stock market high happened in 1999, not in 2020. Yet, we are still far above the historic average, so we can expect the stock market to continue to go down relative to gold.

When measured against gold, the stock market high happened in 1999, not in 2020. Yet, we are still far above the historic average, so we can expect the stock market to continue to go down relative to gold.

Sunday, March 1, 2020

Overextended Chains of Command

History has shown over and over that any system relying on long chains of command do not work. Many a military defeat has been due to an inability to keep command lines open, or due to orders issued by people so far removed from the front line that they completely failed to understand the complex situation at the ground.

It should therefore be self evident that any new world order based on a single ruling body is bound to fail. There is absolutely no reason to fear such an arrangement. If anything, it will serve to weaken government at the local level.

Imagine for a moment a bureaucrat issuing a decree for the entire world from a central command position. The only way this decree can be upheld is if it is faithfully passed on down the chain of command to local government officials in every town and village. But how eager will such government officials be in executing ideas that are neither their own nor very logical as far as the local conditions are concerned.

More likely than not, local bureaucracies everywhere will become extremely inefficient, arbitrary, and reluctant. There will be all sorts of local arrangements that will bypass the central decrees. There will be corruption. There will be mistrust. No-one in the end will trust government to do anything at all. In some places, there will be a complete collapse of the local bureaucratic order. There will be all sorts of clandestine alternatives. The new world order will fall apart even before it is fully implemented.

It should therefore be self evident that any new world order based on a single ruling body is bound to fail. There is absolutely no reason to fear such an arrangement. If anything, it will serve to weaken government at the local level.

Imagine for a moment a bureaucrat issuing a decree for the entire world from a central command position. The only way this decree can be upheld is if it is faithfully passed on down the chain of command to local government officials in every town and village. But how eager will such government officials be in executing ideas that are neither their own nor very logical as far as the local conditions are concerned.

More likely than not, local bureaucracies everywhere will become extremely inefficient, arbitrary, and reluctant. There will be all sorts of local arrangements that will bypass the central decrees. There will be corruption. There will be mistrust. No-one in the end will trust government to do anything at all. In some places, there will be a complete collapse of the local bureaucratic order. There will be all sorts of clandestine alternatives. The new world order will fall apart even before it is fully implemented.

Subscribe to:

Posts (Atom)