A strange and unexpected opinion piece has just been published in IQ magazine. I've never heard of the magazine before, but it looks like a serious opinion maker for the woke left, with focus on all sorts of woke issues. It's therefore noteworthy to see such a dramatic shift in opinion when it comes to the vaccine.

The unvaccinated are no longer blamed for killing grandma. We are instead being blamed for saying too little. It's our fault that those who shouldn't have taken the vaccine went ahead and took it anyway.

My first thought on reading about this in Zerohedge was that this had to be satire. But that would mean that IQ magazine have readers that are open to this kind of dark satire, and that doesn't seem to be the case.

Another possibility is that a clever troll managed to get this opinion piece published, which would mean that the editors found it sincere sounding. It may then just as well have been written by them themselves.

It's also possible that the magazine is part of a psyop operation to rattle the nerves of the gullible and weak minded.

The woke agenda that the IQ magazine appears to be pushing revolves around the idea that the world we live in is deeply unfair and all this unfairness is the fault of everybody else. This is perfect for the fomentation of anger, which can in turn be directed towards political opponent. It's therefore perfectly possible that the site is such a tool.

The name of the site is also a red flag. Any site that professes to be intelligent, sceptical, or woke is usually the exact opposite.

The timing of the article is interesting because it comes at a time when people are waking up to the reality of what has happened over the past three years. Justin Trudeau was recently booed and chased by an angry mob in Canada. Similar protests are appearing in England. The woke, who've been deep asleep, are about to wake up, and it's therefore important to present them with the proper enemy to target when they come round to the slow moving horror show that their lives have become.

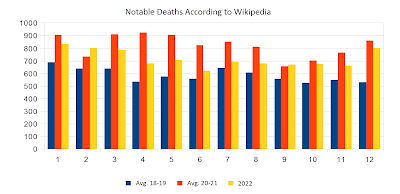

Excess deaths are continuing on their upward trajectory. January looks set to be the worst on record. Hardly a day goes by without some celebrity sportsman dropping dead. Things are getting spooky. Like a true horror story, there are hidden clues that we're supposed to ignore, dark alleys we mustn't explore, and men we must trust with our lives for no good reason at all. What appears to be salvation at the start of the show is revealed to be a trap and all hell breaks loose.

We're seeing people waking up to this fact, and spin-doctors are therefore busy creating the new narrative. We're transitioning from denial to anger. What was but a mild irritation with the unvaccinated a year ago is now turning to rage. But it's not a given that this rage will be directed at the unvaccinated.

The article in IQ magazine seems to have been created for the express purpose of ensuring that their readers turn their anger at their unvaccinated friends and relatives. Similar stories may soon emerge in other outlets, in which case we'll know for sure that the narrative is changing. However, I very much doubt that anyone but the truly gullible will go along with this.

My prediction has been from the start that the final target of the rage that is now brewing will be the censors because they are the people that everyone can point to as the ones behind the mess we're in. Ordinary people can blame the censors, and politicians and journalists can also blame the censors.

Anger may also spill over at politicians and journalists, as seems to be happening in Canada and England. It may also spill over at the unvaccinated. But anger towards the unvaccinated will be hard to foment without some unvaccinated celebrity coming out with a big smug "I told you so" story.

As always in this kind of situations, the answer to our problems is love, the antithesis of which is fear. Things will work out well for the unvaccinated during the upcoming anger stage, provided we refrain from stoking fear and being overly smug about being right.

For those riddled with fear as they wake up to what's going on, we have to give them hope and tell them to have faith in nature, aka God. They made a mistake. They sinned. But if they repent and stop raging against God for what was ultimately their own fault, they will be fine.

As for the further trajectory of the grieving process, we'll see pleading, depression and acceptance. After anger, we'll see a lot of people turn to big pharmaceutical corporations for remedies. Once they realize that no remedy exist, there will be depression, and then finally acceptance. With denial having lasted about a year, we can expect 2023 to be the year of anger. 2024 may become the year of pleading. Depression sets in around 2025, and acceptance kicks in around year 2026.

Important in all of this is how excess deaths will develop as we move forward. If the current experiment goes the same way as previous experiments, we may see fear, rage, depression and apathy develop in parallel. If excess deaths drop off a cliff, the anger stage may pass without much notice. Only time will tell what the future holds.

|

| Notable deaths according to Wikipedia |