For something to command a price it must be seen to have utility, and it must be scarce.

Air is of great importance to us all, yet it commands no price. There is no scarcity of air.

Fresh water on the other hand does command a price. Fresh water does not come for free. There is an infrastructure associated with it which does not build itself. Only those willing to pay for the infrastructure get fresh water delivered to them.

However, water is very cheap relative to other less important things. An ounce of water cost next to nothing. An ounce of gold costs a small fortune.

The reason for the higher price for gold is not that it is more useful than water, but because it is more scarce. Scarcity drives up the price of gold.

But scarcity does not in itself command a price. There has to be perceived utility too. If gold had no utility, it would not command a price. It is the combination of utility as jewelry together with scarcity that people value in gold. This combination gives gold its "intrinsic value".

There are plenty of scarce things that do not command a price. Shares in bankrupt companies are worthless. Nobody is willing to buy such shares. The fact that the number of shares in a bankrupt company will never increase, does not help. Nor does the fact that such shares come with a complete network for trade. Bankrupt shares can be bought and sold on exchanges. There is nothing stopping people from trading in bankrupt shares. Yet they command no price.

The reason for this is that bankrupt company shares have no "intrinsic value". They can be traded. But that's all. There is no utility to bankrupt company shares outside of their ability to be bought and sold. There is no need to own shares in bankrupt companies. There is no benefit to it either.

The "intrinsic value" of central bank issued fiat currency is the fact that it keeps people out of jail.

Every year, a lot of people are obliged to hand in a certain amount of currency to tax collectors who will send these people to jail if they resist. These people are therefore in real need of fiat. Without fiat currency, they loose their freedom. Freedom has utility. People value it, and are therefore willing to work hard in order to preserve what little freedom they have.

The fact that a lot of people do not pay taxes does nothing to lower the value of fiat. Everybody knows that the taxman will send certain people to jail if they don't pay. This gives us confidence in the currency regardless of whether we are directly threatened or not.

The "intrinsic value" of gold, on the other hand is derived entirely from a desire to own it. No taxman is required to give gold its value. The price for gold is ultimately set at the jeweler by people buying a gold ring for marriage or something to impress the wife or girlfriend.

The perceived value of something can of course be completely wrong relative to what it's truly worth. However, prices do average out over time to reflect utility and scarcity.

Tulip bulbs were for a short while in Holland perceived to be immensely valuable, but the mania quickly corrected itself once people realized that a tulip is not an industry, nor a fantastic store of value, but merely a flower.

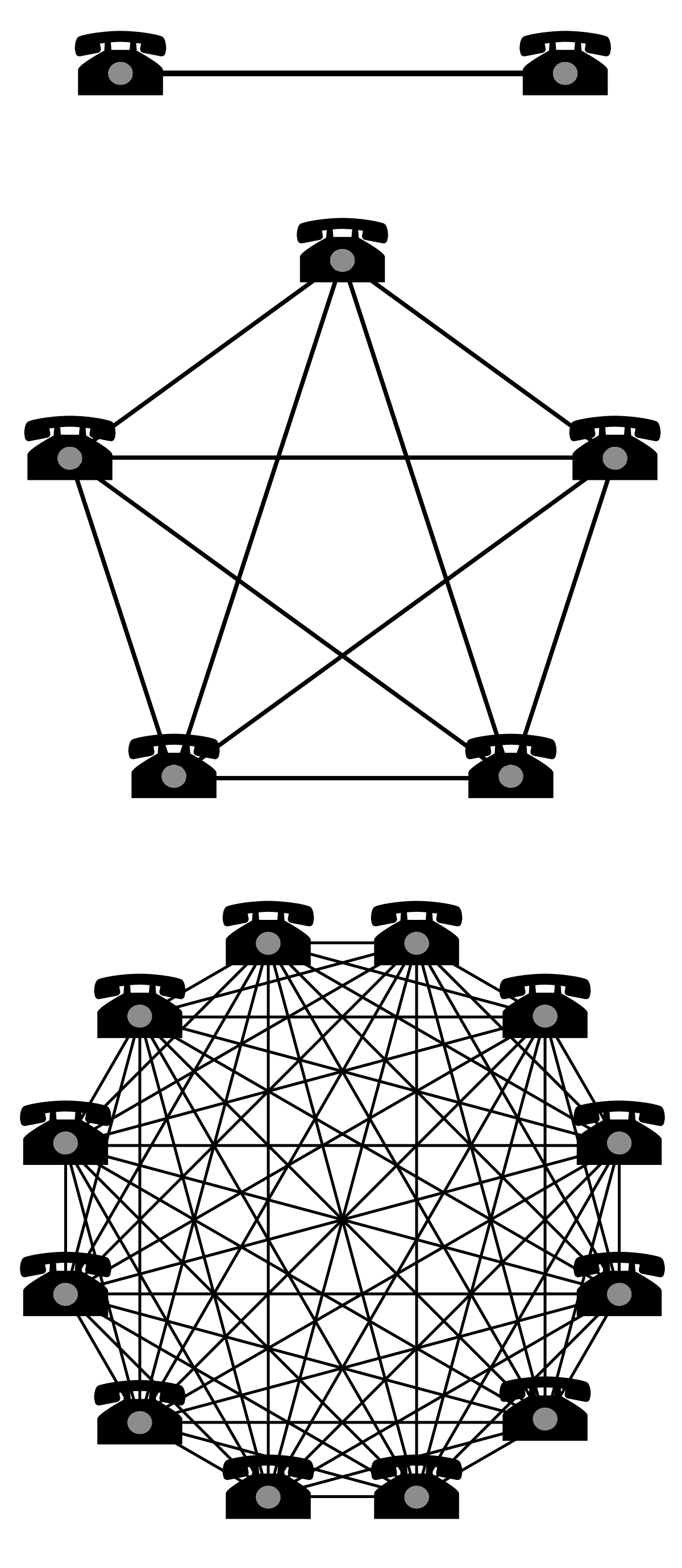

In this perspective, the current price of crypto currencies must be regarded as a mania, soon to crash like the tulip mania in Holland. The reason for this is that crypto tokens have no more "intrinsic value" than shares in a bankrupt company.

Just like shares in bankrupt companies, crypto come in limited numbers, and they can be traded on exchanges. However, the number of different bankrupt companies are not limited. Nor is the number of possible crypto currencies.

There is in fact no real difference between shares in bankrupt companies and crypto currencies. The only difference is the perception that people have about crypto. People perceive crypto to be something more than what it truly is.

People in Holland perceived tulip bulbs to be industry. This misconception lead to the famous tulip mania of the 17th century.

People of today perceive crypto to be investment vehicles, far superior to company stocks. The fact that crypto tokens do not in fact have any more utility than shares in bankrupt companies has not yet widely understood.

However, the lack of "intrinsic value" in crypto is slowly starting to dawn on people. Last weekend saw some wild price action in the crypto sphere. The limited utility and complete lack of "intrinsic value" of Bitcoin sent it down by more than 20 percent. The competing Bitcoin Cash, perceived as having more utility, went up by 400 percent.

It appears that my prediction is coming true that there will be price chaos in crypto before the final crash. When something with no "intrinsic value" commands a price, the price can be anything. There is no limit to the size of the price swings. Total price chaos is the only possible outcome.

|

| Wedding and Engagement Rings |

By Photo by Derek Ramsey (Ram-Man) - Self-photographed, CC BY-SA 2.5, Link