True wealth is leisure, well being and security. A society in which people live long and well is a wealthy society. A good measure of overall wealth in a society is therefore the measure of life expectancy. This happens to be greater in Europe and Canada than in the US. One of the richest countries of them all is Portugal. The fact that Portugal has the lowest GDP number in the western world doesn't accurately reflect the overall well being of its population.

Another measure we can use is the general look and feel of an area. This gives a much more reliable indication as to the local conditions than any GDP numbers can give us. Taking a walk in our neighbourhood, we quickly get a sense of how things are going. If the streets and houses are improving over time, we have economic growth, if things are falling apart or being abandoned all together, we have economic contraction. Walking the streets of Porto, especially down town, we see everywhere signs of economic growth. Immigrants from all over the world are moving to Porto to escape deteriorating conditions in their own countries. They buy properties which they refurbish and improve. They go out and spend. Porto has truly come alive over the 12 years I've lived here.

Some locals complain that the immigrants are pushing up prices. However, many of the houses they have refurbished were uninhabitable before they came. They can hardly be blamed for pushing up prices when the alternative would have been no houses at all. The same can be said for the fancy restaurants. They were simply not there in the past. Cheap housing and food can still be found outside the town centre. The centre has to a certain extent been taken over by foreigners. But was it any better when the centre of town was dilapidated and empty? The improved look and feel of down town Porto is a sure sign of economic growth.

Finally, we can look at our own personal situation. Do we feel better off ourselves? Are we surrounded by people who are doing well? Wealth is after all a subjective matter. It is of no use to know that the politicians are happy with the GDP numbers if we ourselves are feeling increasingly miserable. If we feel healthy and better off, and we see our nearest friends and relatives prosper, if we see our town and neighbourhood improve and feel more prosperous and secure, if we sense an optimism about the future, then we have economic growth.

We live longer and better lives now than we did half a century ago. Some towns and countries are seeing continued improvements in the standard of living. This is evidence of economic growth. Unfortunately, other places are seeing a fall in life expectancy, a general decay of the standard of living, and a sense of deteriorating personal security. Not all areas of the world is experiencing economic growth. While there are pockets of growth, there are also pockets of decay.

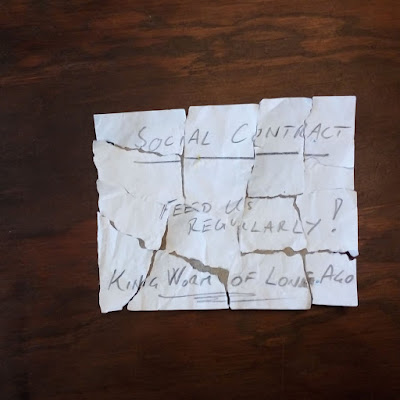

|

| View of Gaia from Porto |