However, this optimistic view assumes that the distribution of short and long positions are perfectly balanced against equally responsible and solvent entities. It ignores the very purpose of derivatives, which is to distribute risk in a manner similar to insurance. One side acts as an insurer so that the other side can take on risk in the real world.

This type of trade is lopsided. Insurance companies make a steady and relative moderate profit for long periods of time, only to take a blow every now and again. Insurance companies must for this reason keep adequate reserves for the occasional hit. But do all entities involved in derivative markets have the same sort of reserves? That remains to be seen.

Banks should in theory be all right. As brokers, they make money on the spread. They take no risk themselves. However, most banks do not only broker derivatives, they have trading desks where they take on risk. More likely than not, they take on the role as insurer, which generates a steady income during good times. But now that times are bad, banks are likely to be wrong footed. With one percent of one quadrillion being ten trillion dollars, even a tiny exposure to the derivatives market is likely to cause havoc in the banking sector.

But banks are not the only entities with a likely wrong footed exposure to derivatives. Insurance companies and pension funds are also likely to have taken on the role as insurer in the derivatives market. They too may suddenly face losses in the trillions now that the tide has turned.

This means that a large number of derivative contracts may default. Those who have steadily rolled over their "insurance policy" for a rainy day may not get paid now that this rainy day has finally arrived. Derivative contracts, guaranteed by insolvent entities will turn out worthless. Companies that thought themselves protected by these contracts will suddenly have to shoulder the full burden of loss themselves. This will in turn lead to bankruptcies in the real economy.

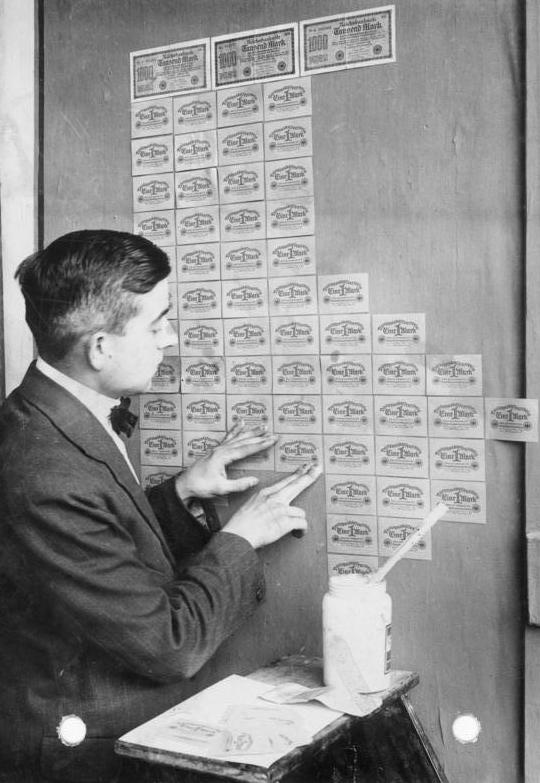

The likely response to all of this by central banks and governments alike will be an orgy of money printing. Fiat currencies are headed to zero.

By Bundesarchiv, Bild 102-00104 / Pahl, Georg / CC-BY-SA 3.0, CC BY-SA 3.0 de, Link

No comments:

Post a Comment