However, greed and fear are not the only emotions reflected in the price of assets. Hope is also present, sometimes in such quantities that it dominates the price action. It can give a great deal of stability to what would otherwise be completely out of control.

The reason hope is such a stable emotion, despite being no more rational than greed, is that the opposite of hope is despair, a far more sinister emotion than fear. Despair leads to depression, suicide and death. It is a truly dangerous emotion.

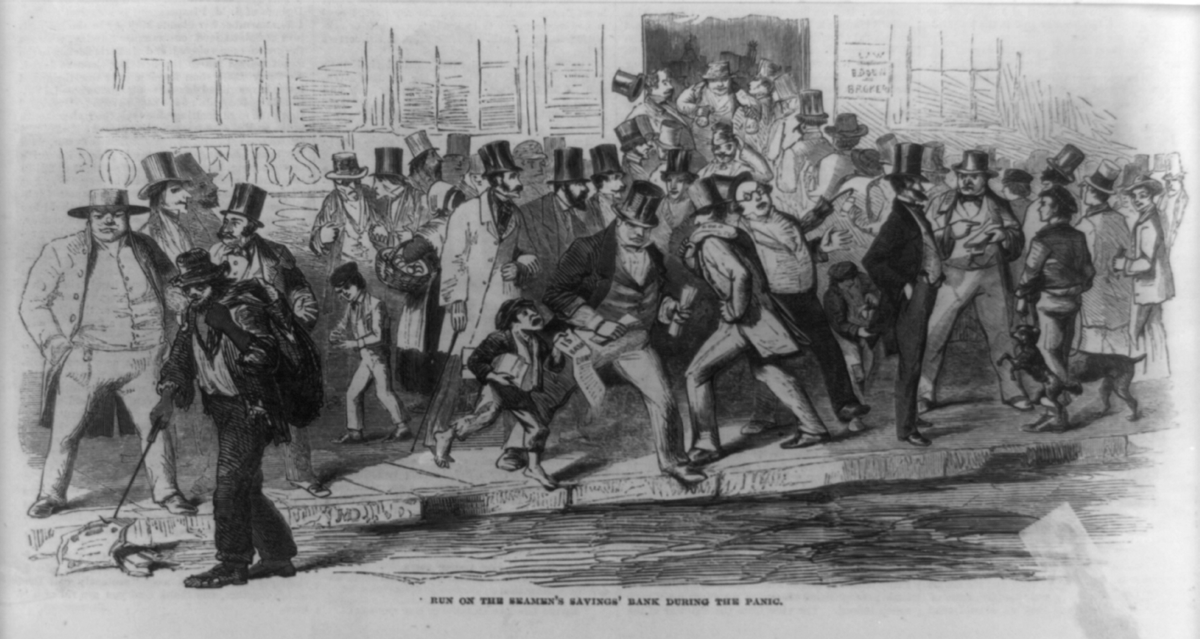

While an over-priced asset governed by greed can quickly fall from its peek, assets governed by hope follow a much slower route. People will cling onto hope for a very long time before giving up. The journey is slow and painful with the occasional relief rally to stoke the hopes of the destitute.

This is what we have seen in Bitcoin since its peek in 2017. People are in Bitcoin, not so much out of greed as out of hope. They see it as their best chance of getting ahead in a world where opportunities are scarce. This is why Bitcoin still fetches a price way above its value as a medium of exchange. The greedy may have left, but the hopeful remain.

Hope will keep Bitcoin elevated for a long while yet, but reality kicks in at some point. When hope finally dies, there will be widespread depression and even suicides among the Bitcoin hopefuls. The final leg of Bitcoin's decline will be sharp, scary and very depressing.

The best thing to do in this situation is to sell and write it all off as a lesson learned. However, that may be too painful to do. A less painful approach is to sell some fraction, or simply stop buying. In any event, do not buy more. It is the ones that keep buying all the way down that ultimately succumb to depression and despair.

By George Frederic Watts and workshop - CgGv3RqPFUZk4A at Google Cultural Institute, zoom level maximum Tate Images (http://www.tate-images.com/results.asp?image=N01640&wwwflag=3&imagepos=1), Public Domain, Link