All times are confusing times, but some times are more confusing than others, and it appears we've entered a particularly rough patch. It's unusually hard to figure out what's going on. In the space of a few weeks, we've had a storming of the capitol, a viral Sanders meme and an insurrection in the markets. All sorts of interpretations can be made with no one standing out as much more believable than another. In the heat of the moment, a sole event is seen as little more than a dumpster fire by some and a systemic threat by others.

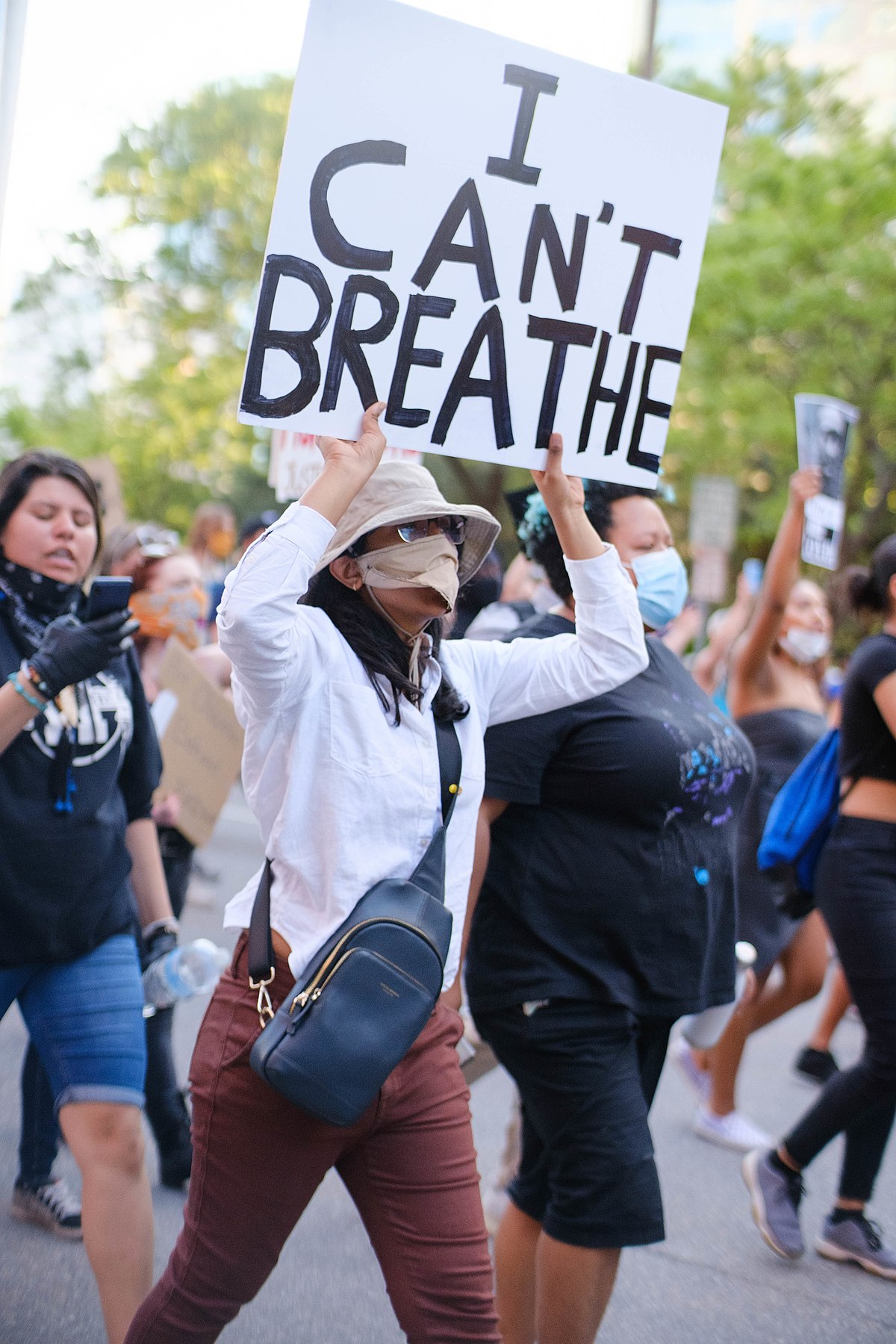

Only in retrospect will it be possible to determine the true significance of current events, and even then, there will be different angles and interpretations. The reason for this is that there's always more than one motivating factor behind an event. There's no single view being expressed. Even the most coherent and honest actors will have more than one motivating factors influencing them. There's always a desire for personal gains, no matter how noble the cause may be, and there's no way to know the exact nature of the cause. No two people have the exact same view of things, and the cause as a whole is therefore a somewhat muddled idea, no matter how simple and concise the rallying calls and slogans may be.

Adding to the confusion, we have honest people with conflicting viewpoints, infiltrators that deliberately confuse issues, and individuals with less than noble intention. Sympathy with the overall cause should not blind us to this fact. Rushing into any of this without proper understanding is more likely to harm us than give us lasting gains. Our first reaction to any grand movement should therefore be caution.

Our best strategy in dealing with the uncertainties of life is to first build a coherent moral framework for ourselves so that we can quickly judge the ethical quality of things going on. Secondly, we need to understand our position in the greater scheme of things. Rather than chasing the hot trends of the moment, we should seek to find the next big thing, and position ourselves for this event. Finally, we have to be careful in picking our battles. We don't personally have to fight in every one. Leave it to others to fight the battles for which we haven't prepared.

Being carried out on a stretcher, with everything lost, doesn't make us a successful revolutionary. It simply means that someone else won. That someone may be the revolutionary leader, or it may be the opponent. Either way, it's not us. We're somebody else's useful idiot, left impotent and broke at the side line of history. That's hardly something to be proud of, no matter how noble the cause may have been. If we're not personally better off at the end of a revolution, chances are that someone else gained at our expense, and that our fight was for nothing.

|

| Revolution |