Six years have passed since I sold my house in Asker, and two years have passed since I last made an assessment related to our financial progress since then. This is in tune with my philosophy of long-term investments, as outlined in my book, which holds that the key to success is to invest in mega-cycles that run for years or decades, and to ride them with little to no change in position. True to this philosophy, our investments haven't been rebalanced. They have been kept in gold, real-estate and cash.

There has been little action in the Dow/Gold ratio over these years, which means that our gold position has been equivalent to being invested in the Dow:

- Jan 2017 = 16.4

- Jan 2019 = 18.2

- Jan 2021 = 16.2

- Jan 2023 = 18.8

|

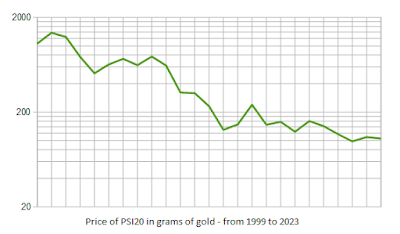

| PSI20 to gold ratio |

My prediction from two years ago was that gold would outperform real-estate in Porto. That hasn't happened. Porto real-estate is up 20% in the period while gold is up around 10%.

As a result, our allocations have made the following relative moves over time:

- Jan 2017: 10 part real-estate, 20 part gold, 5 part cash - for a total of 35

- Jan 2019: 15 part real-estate, 20 part gold, 5 part cash - for a total of 40

- Jan 2021: 20 part real-estate, 30 part gold, 3 part cash - for a total of 53

- Jan 2023: 24 part real-estate, 33 part gold, 3 part cash - for a total of 60

This is a 71% increase in nominal terms over a six year period, which is more than the inflation during those years. However, the increase over the last two years has only been 13% which is roughly the same as inflation.

Looking forward two years, I expect price inflation to move gold and real-estate up against cash, with gold outperforming real-estate. Stocks may continue up in nominal terms but will lag gold. The Dow/Gold ratio is more likely to go down to 10 than up from present levels. The PSI20/Gold ratio will remain flat or go lower in tandem with the Dow.

In short, there's no need for any rebalancing at this point, even if the PSI20 is starting to look attractive.

|

| British gold sovereign |

No comments:

Post a Comment