In this respect, it's interesting to see what is currently happening in the sovereign debt market where there are both free market and central market players. With the FED having interfered heavily in the US debt market to keep prices of US debt from falling, there are now virtually no-one willing to buy US debt voluntarily. The price is simply too high.

But if the FED let's the price of debt fall to the point where free market actors are interested in buying it, interest rates will skyrocket. This is not an option, because it would cripple the US government, so the only option available to the US government is for the FED to become an evermore dominant buyer of its debt. People will no longer give up their hard earned money to buy this. Only money printed out of thin air will go into the debt market. As a consequence, there will soon be an avalanche of freshly printed dollars hitting the free market of goods and services.

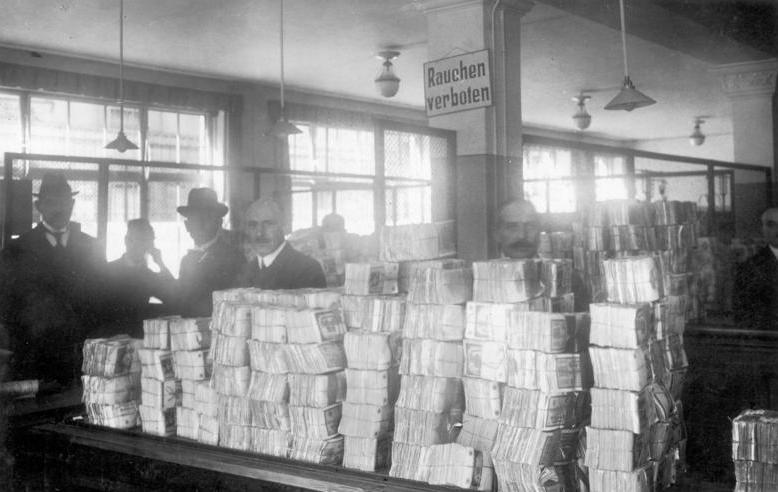

By Bundesarchiv, Bild 183-R1215-506 / CC-BY-SA 3.0, CC BY-SA 3.0 de, Link

No comments:

Post a Comment