One of the lessons from Weimar Germany is that business goes on also when inflation becomes so high that no-one can say what the local currency will buy at a future time. Under such circumstances, local currency can no longer be use for budgeting and contracts. Instead, some other currency is used.

Gold and dollars were popular alternatives to the Mark in Germany during the Weimar hyperinflation of 1922 to 1923. Similarly in Yugoslavia, Zimbabwe, Iran and Venezuela in more recent times, business was conducted in dollars when local currencies failed. But what will happen in the event of high inflation in the world as a whole? How will business be conducted in the absence of any reliable national currency?

The obvious answer to this is gold. But some may argue that a cryptocurrency like Bitcoin will be used instead. However, for that to happen, such currencies must make the transition from speculative assets to money, and there are at least eight reasons why this won't happen. Cryptocurrencies will continue to be volatile assets priced in dollars even in the event of a dollar collapse.

Should the collapse be total, gold will continue to be used until governments of the world either accept it as the standard, or some other standard is chosen. In either event, Bitcoin and other non-government currencies will be ruled out. Gold will either become money once again, or remain a coveted commodity. Crypto on the other hand, will be revealed to be an inferior store of value, and of no use in business.

|

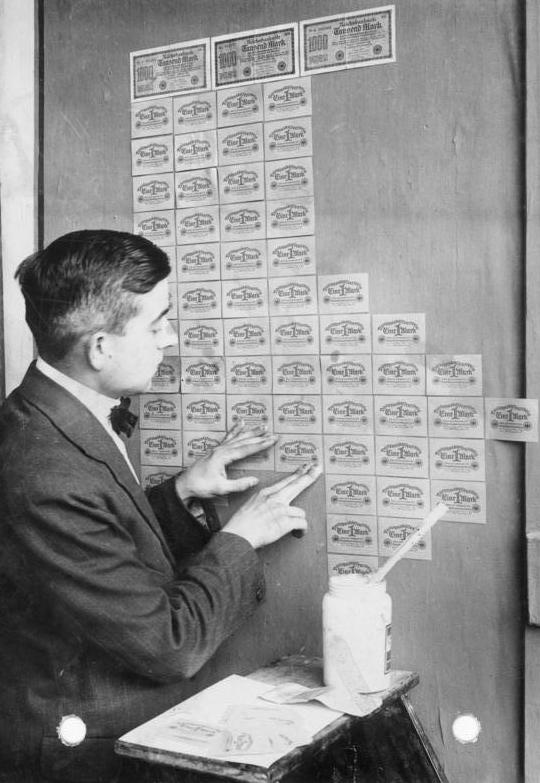

| Wallpaper |

No comments:

Post a Comment