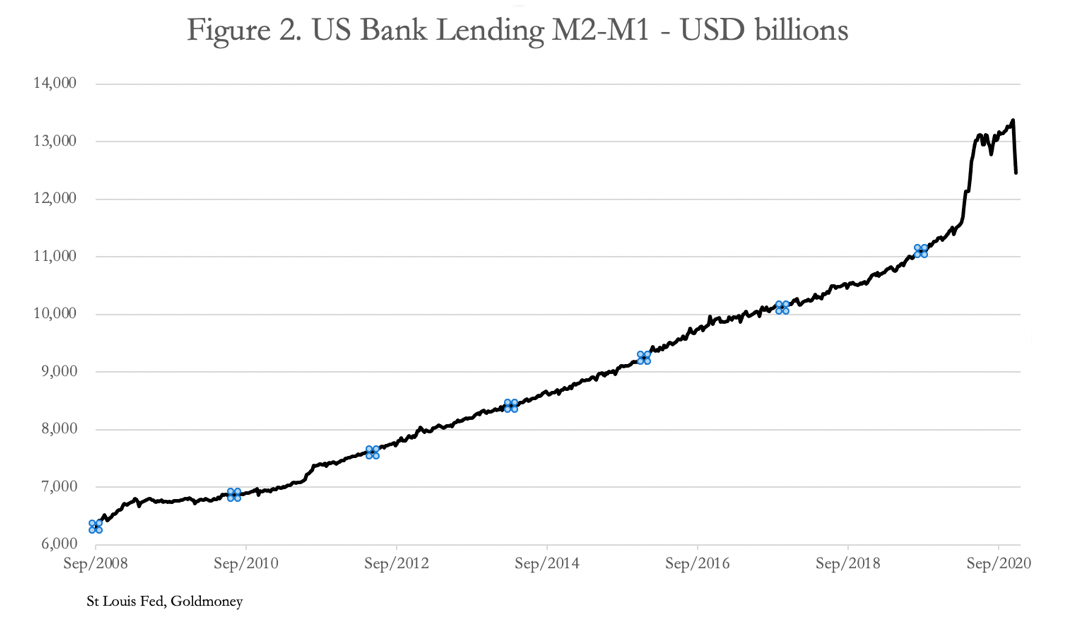

The following chart appeared in a Zerohedge article this morning.

|

| US Bank Lending |

From the shape of it alone, we can see that trouble is on its way. After a sharp increase in lending at the end of 2019, lending is heading straight down.

This means that prices that are dependent on continued credit expansion are likely to suffer greatly in the short term. Speculative bets will be forced to unwind.

There is at present a scramble to unwind bets and pay down debt, which will have the opposite effect of the credit expansion we've just been witnessing. Speculative financial assets will go down in price at a rate at least equal to the rate of the build up.

The mechanism of this is implicit in the current debt based monetary system, where currency is issued through credit expansion. When debt is being paid back, as is currently happening, currency disappears from the system. This creates in turn a currency shortage, sending interest rates higher, forcing more leveraged bets to unwind.

The only way to stop this, short of letting all speculative bets implode, is through direct action by central banks. With no other buyers of debt or speculative assets, central banks will issue currency to buy these assets directly from the market. All this unbacked currency will then hit the market for real goods and services, sending commodities and precious metals soaring in price.

Without direct action, speculative bets implode, with currency becoming increasingly expensive relative to almost all things. However, with companies and institutions going belly up all over the place, gold and silver will be seen as the only secure place to store wealth. This scenario is therefore identical to the alternative when it comes to precious metals. Gold and silver will go up in price no matter what central banks do or don't do.

No comments:

Post a Comment