Financial liquidity refers to the ability of something to deliver cash on demand. A liquid asset is an asset that can easily be sold. A liquid company has no trouble paying its bills. A liquid financial system has sufficient cash to go around so that things can be bought and sold without delay.

Liquidity is the lifeblood of the economy. Liquidity shortages, such as the ones we are currently seeing in the Repo market, are therefore indications of serious underlying problems. There is a mismatch between price and reality. Things have become so expensive that there simply isn't enough cash to pay for it all.

Without central bank intervention, liquidity shortages lead directly to lower prices. Those short of cash are forced to sell more of what they have. Those holding cash can wait until prices again reflect reality. However, with central banks, liquidity can be injected directly into the system. Sellers can bypass the market and go directly to central banks for cash.

Central banks can create cash out of thin air. They can offer any price for an asset, and thereby push prices higher than they otherwise would be. The patient buyer, holding cash in the event of a liquidity shortage, is thereby bypassed. Liquidity is restored without prices having to adjust downwards.

Central banks were created specifically for the purpose of helping out in the event of liquidity shortages. Their interference in loan markets are therefore to be expected. They benefit the over-extended borrower at the expense of the saver. The bargains that the cash holder hopes for, never materialize. Even when prices crash, they bounce up again before they reflect a healthy return on investment. Prices are permanently skewed upwards relative to underlying value.

The long term effect of this is that the cash holder, the so called rentier, has been euthanized, as recommended by John Maynard Keynes. However, this does not solve anything. It merely removes the cash holder from the economy, making central banks the only cash providers. The market is replaced by central banks. Central banks go from being lenders of last resort to lenders of only resort.

With cash holders permanently removed from the economy, any substantial cash demand will have to be met by central banks. Eager to keep asset prices elevated, central banks will continue to offer above market prices. However, resources available to an economy are not without limits. An unlimited supply of cash from central banks will therefore send prices higher, not only for financial assets, but also for resources. Everything becomes more expensive.

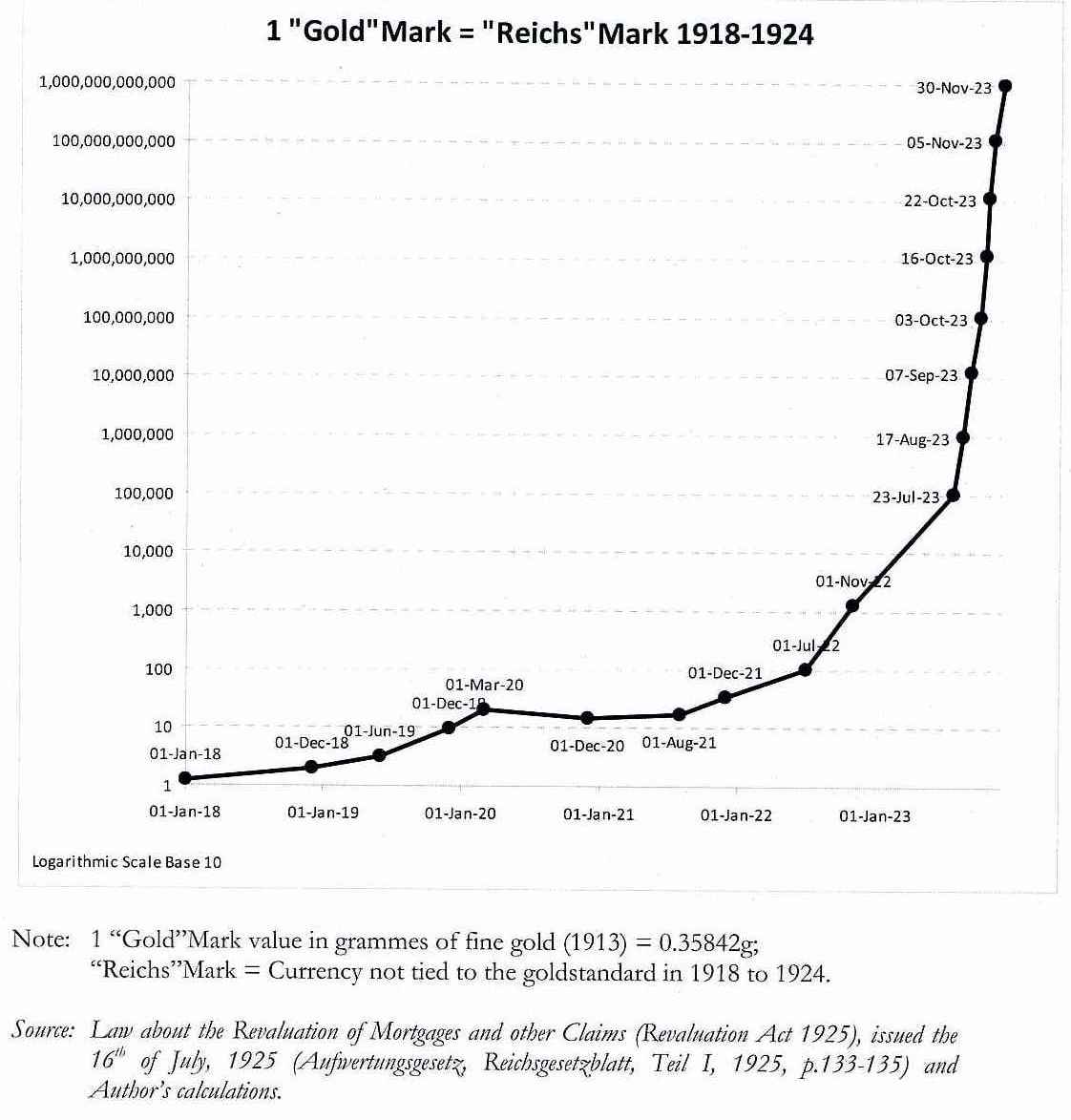

When the price of resources move higher, liquidity shortages reappear. Companies will again find it hard to cover their expenses. They will ask for more cash, which central banks will be quick to provide. The demand for cash will explode higher. Prices for everything will explode higher. Unless central banks change course, we will have hyperinflation.

By Wolfgang Chr. Fischer - Template:Wolfgang Chr. Fischer, CC BY-SA 3.0, Link

No comments:

Post a Comment