A friend of mine suggested the other day that we should go to a Bitcoin standard rather than a gold standard due to the fact that Bitcoin is limited in numbers while gold is virtually endless in supply, so gold might one day be as worthless as sand. This prompted me to write the following reply:

Gold is a material that's used in jewellery and computers. This makes it a thing that we value relative to other things. If things in general become more expensive over time, as we've seen happening over the last 100 years, gold too becomes more expensive. Bitcoin, on the other hand, is not a material we can use to make things. No-one needs Bitcoin to produce stuff. However, gold is needed in computers, some of which are used to store Bitcoin. If Bitcoin suddenly isn't used in transactions, there's no value in it. That wasn't the case for gold when we went off the gold standard. Gold was still needed for jewellery and industry. The price of gold went up when we got off the gold standard. The same will not happen to Bitcoin the day no-one bothers to keep it.

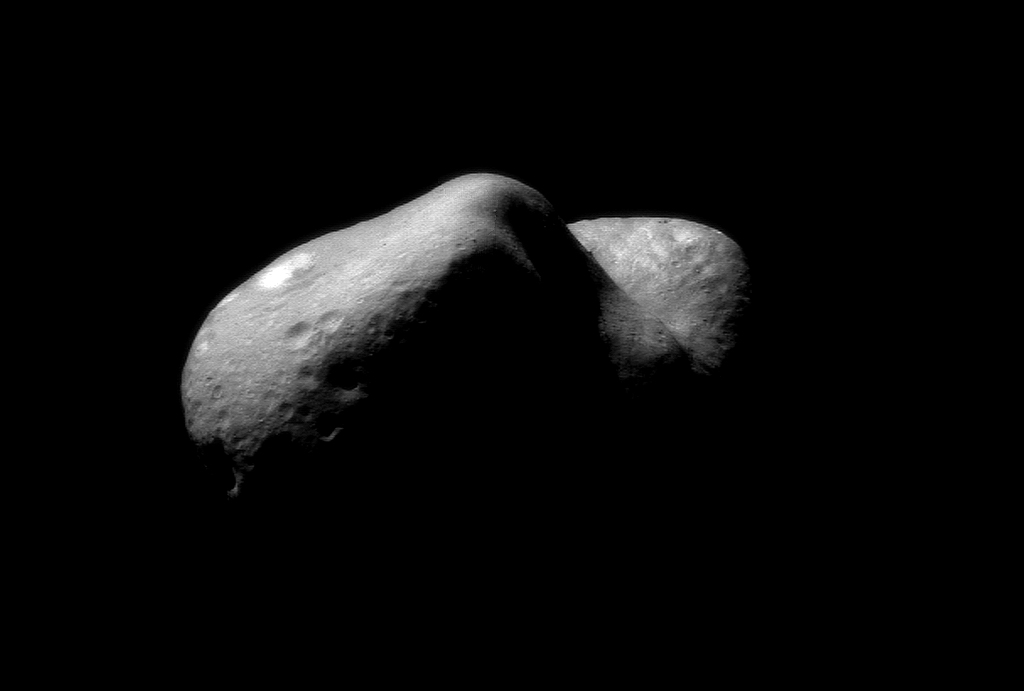

Furthermore, materials are not priced according to their quantity, but according to their ease of production and the demand for their use. The universe contains an endless supply of materials of all sorts, including gold. But the cost of accessing and refining gold is so high that it will never be priced as low as sand, no matter how many gold asteroids Elon brings down to Earth. One kilogram of gold will always be priced somewhere between a car and a house.

I sold a house in Norway for a price corresponding to 16 kilogram of gold back in 2017. That same house is today priced at 10 kilogram. House prices in Norway have gone down relative to gold, and will most likely continue to do so since their prices are still historically high. The fact that we can read historic prices in terms of gold is one reasons for its status as money. By reading all prices relative to gold, rather than Kroner or Dollar, we can uncover hidden trends. Measured in Kroner, house prices in Norway are continuing up, but the gold price reveals a different truth. The same is true for the stock market which is lower relative to gold than it was in 2000.

|

| Asteroid |

By NASA/NEAR Project (JHU/APL). - http://nssdc.gsfc.nasa.gov/planetary/image/near_20000214_mos2.jpg from http://nssdc.gsfc.nasa.gov/planetary/mission/near/near_eros_2.html, Public Domain, Link

No comments:

Post a Comment