Implicit in this thinking is the idea that there's no strength without weakness, and there's no weakness without strength. We must therefore look at our strengths and weaknesses with a mix of hope and suspicion. I am for instance inclined towards laziness. I'm also quick to jump to conclusions. Jokingly, I refer to these as my strong points, and in a way I'm right. My determination to do as little as possible sparks creative and strategic thinking that helps me position myself favorably in the currents of the Tao. My tendency to jump to conclusions is similarly helpful in that I quickly pick up on anomalies. Whenever my conclusions differ from that of experts, I'm either onto something interesting or in need of education. Either way, I might want to reconsider my positions after looking into the anomalies in greater details.

This is distinct from Judeo-Christian doctrine that frequently deals in absolutes. Jews and Christians have an all powerful God, and a constantly scheming and evil devil. These are distinct entities. They do not appear at first sight to be anything but sworn enemies to each other. However, on closer inspection, we see that the two are closely related. God is never so powerful as to completely eradicate evil, and the devil is never so successful as to ever replace God. They exist in a yin-yang relationship.

Seen in this light, the stories about God and his relationship to the devil become easier to understand. God is in fact the all mighty Tao. He represents the relentless power of nature in all its forms. Satan is God's smartest, most well spoken and charismatic arch angel. He represents human aspirations towards perfection. Satan wants to become God by being smarter than God. However, this is impossible. There's no way to do better than God. All we can do is to live sensibly within the confines of nature. We cannot live beyond nature without getting ourselves into a terrible mess. If we follow Satan's advice, we end up in hell. Physically and emotionally, things fall apart if we try to defy God, and that's why Satan was kicked out of God's court.

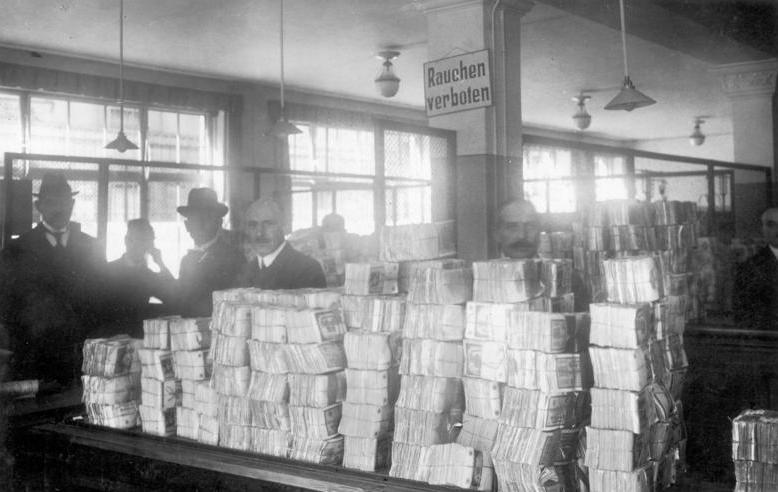

Satan is not a sadistic evildoer. He doesn't boil and torment human souls for fun. He's merely of the opinion that he can do better than God, and it's in this perspective that we can identify him in both our own thinking and in the rhetoric of others. Whenever we hear ourselves thinking that we can do better than everybody else, that we are smarter than others, more deserving than others, better than others, we are hearing the voice of Satan. The same applies to politicians who claim that they can suspend the laws of economics. Only Satan makes such suggestions, and we have to keep away from such thinking for our own good, because this kind of advice leads directly to hell in the form of depression, envy, anger and anxiety.

The story about Satan and his relationship with God is a warning to all clever people. It's also a warning to people who blindly trust demagogues that promise something for nothing. While being clever and charming is a strength, being too clever is a curse. There's simply no way around the Tao. While we can position ourselves favorably in its great current, and take advantages of its force, we can never do better than what is already provided. That's why the wise treat nature with due respect. The wise know that the power of the Tao will crush anyone that tries to oppose it.

By Gregory Maxwell - From File:Yin yang.png, converted to SVG by Gregory Maxwell., Public Domain, Link